Reporting Non-covered Shares

You do have to report non covered security transactions on Form 8949 which flows to schedule D. You are responsible for reporting the sale of noncovered shares.

Use This Free Social Media Report Card Template To Wow Your Boss And Clients Photoshop Psd Social Media Marketing Tips Social Media Swansea Wales Andre Social Media Report Social

Use This Free Social Media Report Card Template To Wow Your Boss And Clients Photoshop Psd Social Media Marketing Tips Social Media Swansea Wales Andre Social Media Report Social

You can still use all methods allowed by the IRS to track your cost basis.

Reporting non-covered shares. In the Form 1099-B Type drop down menu. You must report the sale of the noncovered securities on a third Form 1099-B or on the Form 1099-B reporting the sale of the covered securities bought in April 2020 reporting long-term gain or loss. Cost basis means that the original cost of any asset must be revised annually according to depreciation in the case of fixed assets and must be increased in the case of capital expenditure market value appreciation etc.

In Drake T ax there is no data entry field for Box 5 Check if non-covered security. A covered security is one whose sale requires disclosure of the cost basis. The form has a summary part that lists the Long Term Noncovered and then Long Term Covered and Noncovered and provides the basis.

Non-covered securities are any securities purchased or acquired before the above effective dates. For noncovered shares the cost basis reporting is sent only to you. If Box 5 is marked on the taxpayers Form 1099-B.

When filing your tax return you will be required to use the cost basis reported on your IRS Form 1099-B for covered shares. Box 1b Date acquired. To enter the sale of a covered or non-covered security from the Main Menu of the Tax Return Form 1040 select.

For covered shares were required to report cost basis to both you and the IRS. Box 1e Cost or other basis. Transactions involving assets purchased and held prior to these effective dates can still be reported as they have been in the past meaning that brokers may not provide detailed cost basis reporting to the IRS on the sales of non-covered.

The broker may but is not required to report the following information. Transactions not reported on Form 1099-B. For covered shares were required to report cost basis to both you and the IRS.

Therefore you are not required to report cost basis for the non covered securities but you still must report the sale and subsequent capital gain that is reported on 1099-B. For tax-reporting purposes the difference between covered and noncovered shares is this. These are also non-covered securities.

Non-covered securities are usually reported here using code B for short-term holdings and code E for long-term holdings. Enter on screen 8949 field 1e. The cost basis method that will be used for all non-covered shares is Average Cost.

For tax-reporting purposes the difference between covered and noncovered shares is this. Non-covered shares are shares purchased by a shareholder on or before December 31 2011. Code C is used for short-term holdings and code F is used for long-term holdings.

You may check box 5 if reporting the noncovered securities on a third Form 1099-B. You are responsible for reporting the sale of noncovered shares. Brokers will not report the cost basis for shares bought before the cutoff date no matter when you sell them.

For tax-reporting purposes the difference between covered and noncovered shares is this. As of 2011 the IRS requires brokers to report the cost basis of most stock sales on Form 1099-B. For a covered security select Box 3 Cost Basis Reported to the IRS.

For noncovered shares the cost basis reporting is sent only to you. These include first-in first-out FIFO specific identification and average cost only for mutual fund shares. You are responsible for reporting the sale of noncovered shares.

Definitions vary by investment type. Enter on screen 8949 field 1b. A non-covered security is an SEC designation under which the cost basis of securities that are small and of limited scope may not be reported to the IRS An investment security bought in 2011 but.

Tax Form 1099-B will provide cost basis information for covered shares to both the shareholder and the IRS. Capital GainLoss Sch D Select New and enter the description of the security. Generally when you sell exchange or otherwise dispose of a capital asset most property you own and use for personal purposes pleasure or investment is a capital asset including your house furniture car stocks and bonds you report it on Form 1040 or 1040-SR Schedule D.

Non-covered shares will continue to be reported as they have in the past only the gross proceeds will be reported to the IRS. Form 8949 is a new form this year and requires reporting of cost basis for all covered securities. For noncovered shares the cost basis reporting is sent only to you.

For covered shares were required to report cost basis to both you and the IRS. Those shares are so-called noncovered shares. Mutual funds will now report the cost basis for all covered shares to both you and the IRS.

For noncovered securities you are responsible for reporting cost basis information to the IRS when you file your taxes. The term non-covered security refers to a legal definition of securities the details of which may not necessarily be disclosed to the Internal Revenue Service IRS. In the TOTAL REPORTABLE AMOUNTS section it lists the total PROCEEDS box d and then the TOTAL Reportable Cost or Other Basis box 1e.

If you do not report your cost basis to the IRS the IRS considers your securities to have been sold at a 100 capital gain which can result in a higher tax liability.

Example Of Can Do Descriptor Reports For Newcomers Report Card Template Progress Report Template School Report Card

Example Of Can Do Descriptor Reports For Newcomers Report Card Template Progress Report Template School Report Card

Https Www Schwab Com Public File P 5799523 Spscostbasisfactsheet2021 Final Pdf

Https Www Irs Gov Pub Irs Pdf I1099int Pdf

Https Communications Fidelity Com Sps Library Docs Bro Tax Espp Click Pdf

How To Report A Disallowed Loss Amount On Schedule D

How To Report A Disallowed Loss Amount On Schedule D

Deciphering Form 1099 B Novel Investor

Deciphering Form 1099 B Novel Investor

Invoice Template Invoices Gse Bookbinder Co Locksmith Invoice Template Simple Format Maharashtra Luxereal Invoice Template Free Resume Builder Resume Objective

Invoice Template Invoices Gse Bookbinder Co Locksmith Invoice Template Simple Format Maharashtra Luxereal Invoice Template Free Resume Builder Resume Objective

Retail Manager Resume Examples Inspirational Best Store Manager Resume Example Resume Examples Manager Resume Job Resume Examples

Retail Manager Resume Examples Inspirational Best Store Manager Resume Example Resume Examples Manager Resume Job Resume Examples

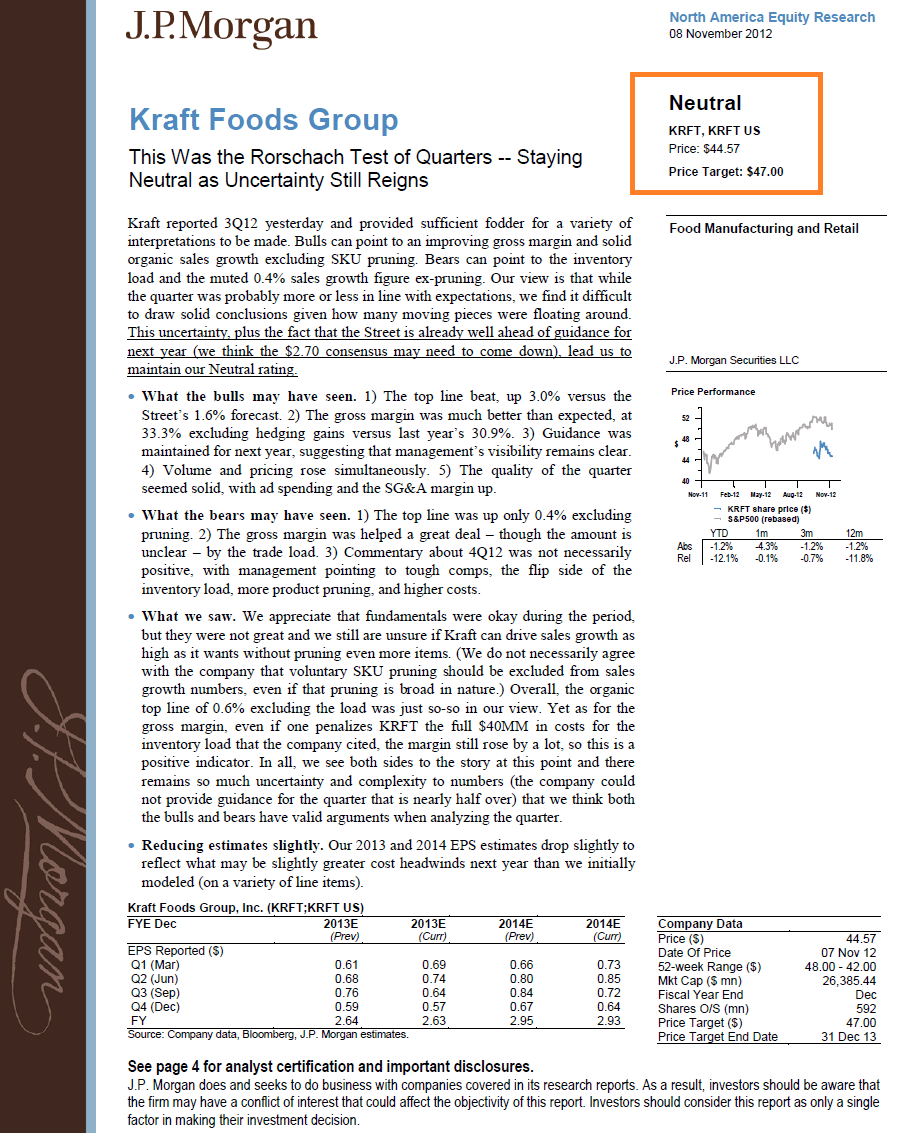

Equity Research Report An Inside Look At What S Actually Included

Equity Research Report An Inside Look At What S Actually Included

Https Advisor Morganstanley Com The Livesay Balzano Group Documents Field L Li Livesay Balzano Group Tax Filing Basics For Stock Plan Transactions Pdf

Https Personal Vanguard Com Pdf 1099comb 012020 Pdf

Form 1099 B From Brokerage For The Sale Of Stocks Taxact Blog

Form 1099 B From Brokerage For The Sale Of Stocks Taxact Blog

A Guide To Employee Stock Options And Tax Reporting Forms

A Guide To Employee Stock Options And Tax Reporting Forms

Pin On Collectible Stocks Bonds

Pin On Collectible Stocks Bonds

Https Www Fidelity Com Bin Public 060 Www Fidelity Com Documents Taxes 2018 Mf 1099 Instructions Pdf

Reporting Late To Work Warning Letter How To Write A Reporting Late To Work Warning Letter Downl Letter Template Word Letter Templates Free Letter Templates

Reporting Late To Work Warning Letter How To Write A Reporting Late To Work Warning Letter Downl Letter Template Word Letter Templates Free Letter Templates

Covered Non Covered Basis Options Trading Tax Info Ticker Tape

Covered Non Covered Basis Options Trading Tax Info Ticker Tape

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Covered Non Covered Basis Options Trading Tax Info Ticker Tape

Covered Non Covered Basis Options Trading Tax Info Ticker Tape